Detrimental debt

A breakdown of the Congressional Budget Office’s latest announcement

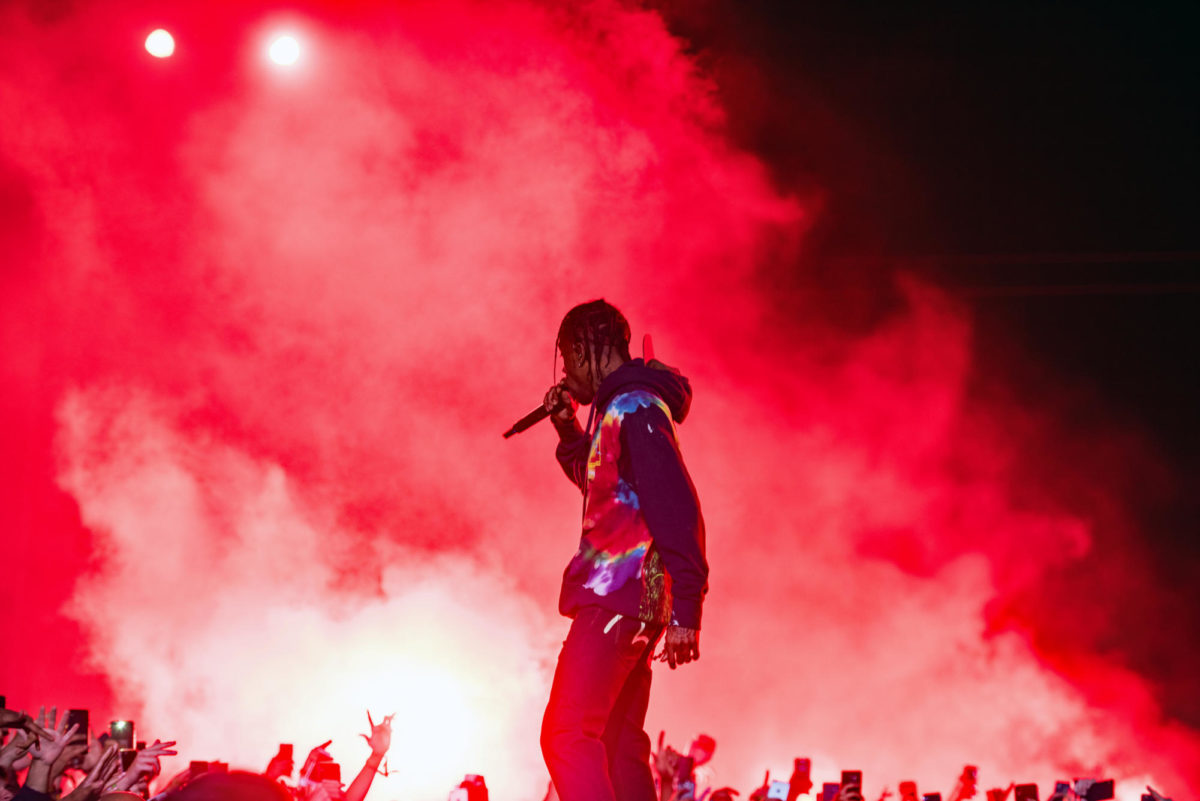

Photo courtesy of Creative Commons

After the Congressional Budget Offices’ announcement on May 12, Americans are waiting for more information before the month ends.

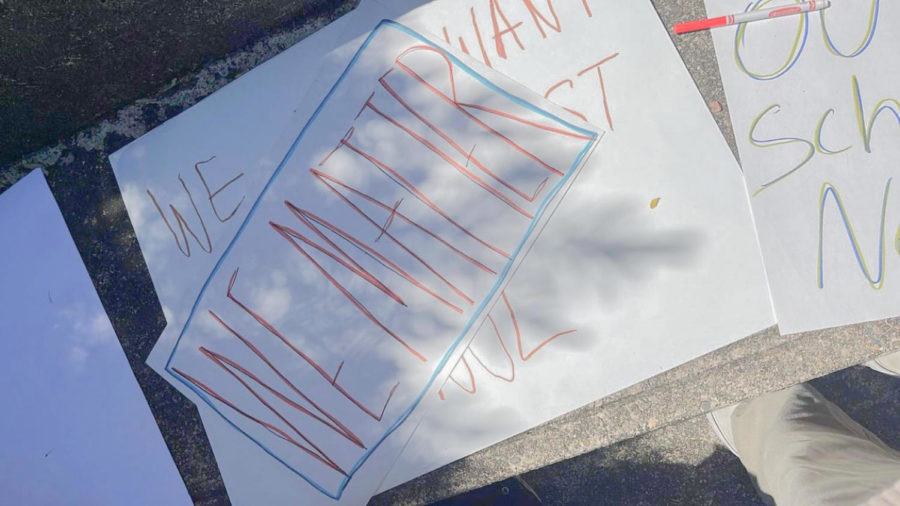

With events like the overturning of Roe v. Wade (1973), to discussions about banned books, politics have become an increasingly polarizing issue amongst voters. A number of political debates have been the topic of discussion in households around the country over the past year.

Recently, efforts to raise the debt ceiling, the legal amount of money a government can borrow, has become an increasing issue among policymakers.This has caused government shutdowns and rising tension among lawmakers.

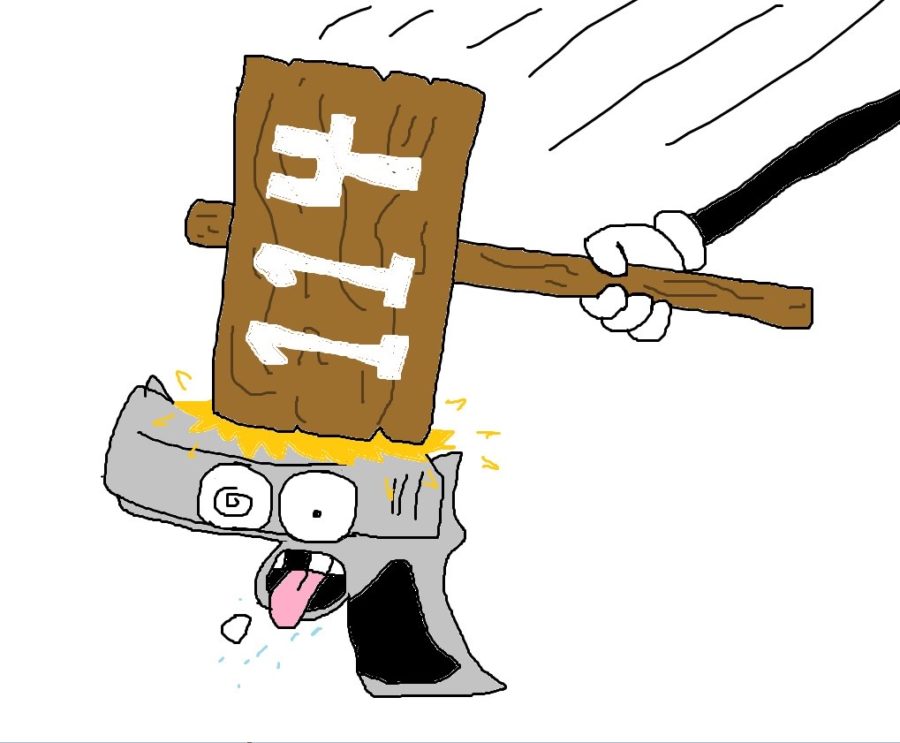

On May 12, the Congressional Budget Office (CBO) announced that there is a “significant risk” the U.S. will go into default within the first two weeks of June if the debt ceiling remains unchanged. A default occurs when the government surpasses its legal borrowing limit and can no longer pay back its debt back in full when it’s due.

“The extent to which the Treasury will be able to fund the government’s ongoing operations will remain uncertain throughout May, even if the Treasury ultimately runs out of funds in early June,” CBO stated.

According to The Council on Foreign Relations, Congress has authorized trillions of dollars over the last decade, with the U.S.’s debt almost tripling since 2009. During that time, the Treasury Department has repeatedly faced congressionally mandated limits regarding their ability to borrow money, known as the “debt limit” or “debt ceiling.”

Congress created the debt ceiling in 1917 to set the maximum amount of outstanding federal debt the U.S. Government could obtain. Throughout history, the debt ceiling has been raised numerous times, including eight times under Bill Clinton, and seven times under George W. Bush. According to the Treasury Department, Congress has raised the debt ceiling a total of 78 times, with 49 of these enacted by Republican presidents, and 29 by Democratic presidents.

A statement issued by the White House on May 3 said , “defaulting on our government’s debt could reverse the historic economic gains that have been achieved since [Biden] took office.” These “economic gains” included an unemployment rate near a 50-year low, the creation of 12.6 million jobs, healthy household balance sheets, supported paychecks, and more.

While the full effects of the potential default remain uncertain, economists have declared potential consequences if the government is unable to pay its bills by June 1. According to ABC News, in a letter to House Speaker Kevin McCarthy, Treasury Secretary Janet Yellen wrote that a default would, “cause severe hardship to American families.”

Payments on government funded programs such as Medicare and Medicaid, SNAP food assistance, veterans’ benefits, and school lunch programs could affect families across the country. Additionally, the U.S. credit rating is predicted to drop as interest rates will likely increase for businesses and homeowners alike.

The threat of a potential default is enough to create chaos in the market. In 2011, Barack Obama fought congressional Republicans over government spending, resulting in pushback from investors and consumers. Stock prices plunged, causing fluctuations in the market.

The cost of borrowing for companies also increased, which made it significantly more expensive for corporations to make investments. In lieu of these events, consumer spending decreased, causing a downward spiral in the economy.

While an economic crisis impacts Americans across the country, some teenagers face hardships in the process. According to the U.S Bureau of Labor Statistics, changes in economic conditions may affect the demand for teenage workers, future employment expectations, financial and emotional stressors as a result of job losses experienced by family or friends.

With this in mind, economists and consumers alike are worried about the potential consequences of default. Before May ends, Americans will be waiting for more information as government officials continue to discuss solutions.

Your donation will support the student journalists of West Linn High School. Your contribution will allow us to continue to produce quality content by purchasing equipment, software, and continuing to host our website on School Newspapers Online (SNO).

Sydney McCrone, senior, is the Social Media editor for wlhsNOW.com, and has been channeling her love of writing since her freshman year. When she is...

![Game, set, and match. Corbin Atchley, sophomore, high fives Sanam Sidhu, freshman, after a rally with other club members. “I just joined [the club],” Sidhu said. “[I heard about it] on Instagram, they always post about it, I’ve been wanting to come. My parents used to play [net sports] too and they taught us, and then I learned from my brother.”](https://wlhsnow.com/wp-content/uploads/2024/03/MG_7715-2-1200x800.jpg)

![The teams prepare to start another play with just a few minutes left in the first half. The Lions were in the lead at halftime with a score of 27-0. At half time, the team went back to the locker rooms. “[We ate] orange slices,” Malos said. “[Then] our team came out and got the win.”](https://wlhsnow.com/wp-content/uploads/2023/10/IMG_2385-1200x800.jpg)

![At the bottom of the third inning, the Lions are still scoreless. Rowe stands at home plate, preparing to bat, while Vandenbrink stands off to the side as the next batter up. Despite having the bases loaded, the team was unable to score any runs. “It’s just the beginning of the season. We’re just going to be playing out best by June, [and] that’s where champions are,” Rowe said.](https://wlhsnow.com/wp-content/uploads/2024/03/IMG_3077-1200x900.jpg)