Why you should stop complaining about taxes and look at the federal budget

Most Americans are very well familiar with our country’s creation: “no taxation without representation” (among other issues). Taxes and tariffs have always been topics that cause much controversy in the United States. It’s a decidedly nonpartisan opinion that we don’t want to pay a lot of money in taxes. The problem with this is that almost everyone wants something from the government, causing it to expand, and thus requiring more money to operate.

According to the British Broadcasting Corporation, these are the average amounts wage earners take home after taxes:

- Italy – 50.59%

- India – 54.90%

- United Kingdom – 57.28%

- France – 58.10%

- Canada – 58.13%

- Japan – 58.68%

- Australia – 59.30%

- United States – 60.45% (based on New York state tax)

- Germany – 60.61%

- South Africa – 61.78%

- China – 62.05%

- Argentina – 64.02%

- Turkey – 64.64%

- South Korea – 65.75%

- Indonesia – 69.78%

- Mexico –70.60%

- Brazil – 73.32%

- Russia – 87%

- Saudi Arabia – 96.86%

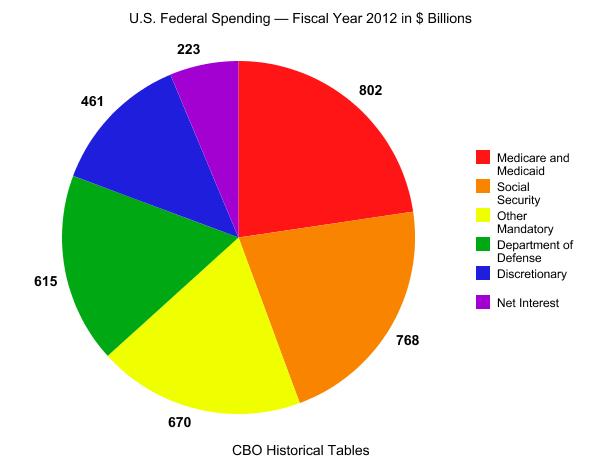

Looking at the percentages, the U.S. does moderately well compared to most of the nations listed, and better than most of the European countries. (Note: The majority of our federal revenue comes from income taxes.) Take into account that the federal government still does not take in enough money to pay for its yearly spending, creating a deficit and driving the U.S. deeper into debt.

However, if we wanted to do better (as in increase the amount we take home by increasing taxes), we’d have to cut current programs that we feel entitled to. Programs such as Social Security, Medicare, and Medicaid would need to be severely cut (which will have to happen anyway unless we want our budget to bust in the 2030s), as we spend more than $3 billion per day on these programs. Along with reducing social service spending, we would also need to cut tax expenditures given to both individuals and corporations. As much as some Americans like to preach that they want a small government, the reality is that a vast majority of them would greatly dislike the matter in which we would downsize.

Social service spending in 2008 accounted for two-thirds of the federal budget alone. We can try to blame FDR for his government’s financial polices and federal programs that were put into place, but more of the blame probably resides with the generations in control of the government after FDR. They did nothing to reduce and cut those programs, purely because their constituencies did not want them to. Ultimately, all past American generations that have held political power have had a part to play in the steady increase of our federal spending over the past 80 years.

Along with limiting social service spending, another way to make taxation simpler and possibly more affordable would be to simplify the nation’s 16,845 page-long tax code. Unfortunately, politicians seem largely not up to the task, leaving it for future generations to deal with.

Sources:

Carter, B. (2014, February 14). Which country has the highest tax rate?. BBC News. Retrieved May 1, 2014, from http://www.bbc.com/news/magazine-26327114

Edwards, G. C., & Wattenberg, M. P. (2009). Government in America: people, politics, and policy (14th ed., Advanced placement ed.). New York: Longman.

Farcaster. (2012, January 31). File:U.S. Federal Spending – FY 2011.png. . Retrieved May 1, 2014, from http://en.wikipedia.org/wiki/File:U.S._Federal_Spending_-_FY_2011.png

Your donation will support the student journalists of West Linn High School. Your contribution will allow us to continue to produce quality content by purchasing equipment, software, and continuing to host our website on School Newspapers Online (SNO).

Riding on her galloping horse at Stafford Hills Equitation, Meredith Bowers, junior, enjoys spending her free time at the stables. Bowers has...

![Game, set, and match. Corbin Atchley, sophomore, high fives Sanam Sidhu, freshman, after a rally with other club members. “I just joined [the club],” Sidhu said. “[I heard about it] on Instagram, they always post about it, I’ve been wanting to come. My parents used to play [net sports] too and they taught us, and then I learned from my brother.”](https://wlhsnow.com/wp-content/uploads/2024/03/MG_7715-2-1200x800.jpg)

![At the bottom of the third inning, the Lions are still scoreless. Rowe stands at home plate, preparing to bat, while Vandenbrink stands off to the side as the next batter up. Despite having the bases loaded, the team was unable to score any runs. “It’s just the beginning of the season. We’re just going to be playing out best by June, [and] that’s where champions are,” Rowe said.](https://wlhsnow.com/wp-content/uploads/2024/03/IMG_3077-1200x900.jpg)

![The teams prepare to start another play with just a few minutes left in the first half. The Lions were in the lead at halftime with a score of 27-0. At half time, the team went back to the locker rooms. “[We ate] orange slices,” Malos said. “[Then] our team came out and got the win.”](https://wlhsnow.com/wp-content/uploads/2023/10/IMG_2385-1200x800.jpg)